LTC Price Prediction: Bullish Trend Supported by Technicals and Market Sentiment

#LTC

- LTC is trading above its 20-day moving average, indicating a bullish trend.

- MACD shows weakening downward momentum, hinting at a potential reversal.

- Positive market sentiment from regulatory and institutional adoption could further support LTC's price.

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerging

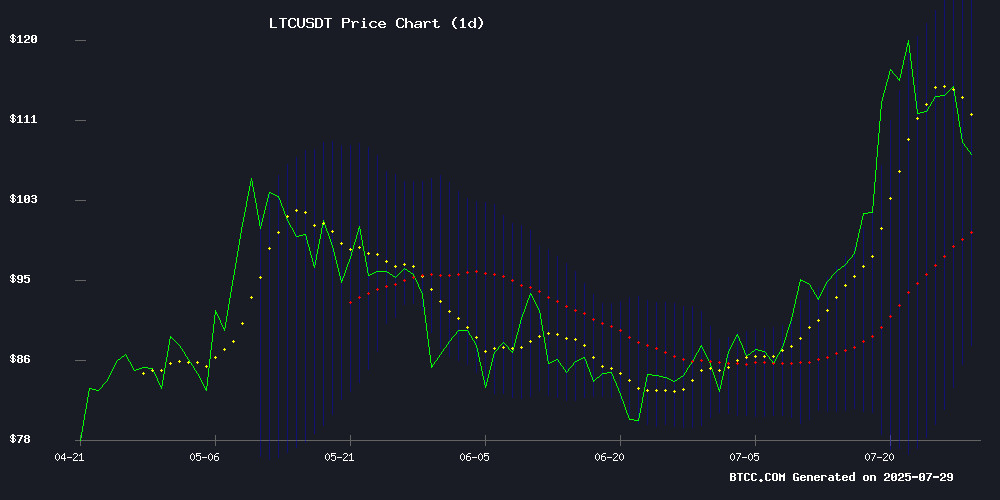

According to BTCC financial analyst Emma, Litecoin (LTC) is currently trading at $109.68, above its 20-day moving average of $105.98, indicating a bullish trend. The MACD histogram shows a slight improvement, though still in negative territory, suggesting weakening downward momentum. Bollinger Bands indicate volatility with the price near the upper band, which could signal overbought conditions in the short term.

Crypto Market Sentiment Boosted by Regulatory and Institutional Adoption

BTCC financial analyst Emma notes that recent news, including the Trump administration's push to integrate cryptocurrencies into retirement plans and mortgages, has positively impacted market sentiment. The expansion of the U.S. Strategic crypto Reserve with a focus on altcoins and the surge in BNB further highlight growing institutional interest, which could benefit LTC as part of the broader altcoin market.

Factors Influencing LTC’s Price

BNB Surges 6% as Investors Explore BTC Miner Cloud Mining

Binance Coin (BNB) led the crypto market with a 6.17% rally, climbing from $794.70 to $843.77, while Bitcoin maintained its position above $119,000 and Ethereum hovered near $3,900. Amidst the volatility, savvy investors are quietly shifting focus to BTC Miner's cloud mining contracts, which offer daily returns of up to 7%, decoupled from spot market fluctuations.

BTC Miner simplifies cryptocurrency mining by eliminating hardware hassles. Users can register with an email, claim a $500 trial credit, and select from flexible contract options tailored to their investment goals. The platform supports multiple assets, including USDT, BTC, ETH, and BNB, ensuring global accessibility.

The appeal lies in predictable yields, mobile app convenience, and transparent operations. With one-click activation and 24/7 monitoring, BTC Miner caters to investors seeking stability in a turbulent market.

Trump Administration Moves to Integrate Cryptocurrencies into Retirement Plans and Mortgages

The Trump administration is pushing forward with plans to bring cryptocurrencies into mainstream financial systems. An upcoming executive order will allow 401(k) retirement plans to include digital assets, potentially opening crypto investing to millions of Americans. Currently, 401(k) plans are largely restricted to traditional investments like stocks and bonds.

In a parallel move, the Federal Housing Finance Agency has directed Fannie Mae and Freddie Mac to consider borrowers' cryptocurrency holdings as eligible assets for mortgage backing. William Pulte, the agency's director, framed this as part of President Trump's vision to establish the U.S. as the global leader in cryptocurrency.

The administration's comprehensive crypto strategy report is expected Wednesday from its digital assets working group. These developments come despite opposition from Democratic senators, including Elizabeth Warren, who cite concerns about crypto's volatility in mortgage applications.

Trump Expands USA’s Strategic Crypto Reserve with New Altcoin Focus

President Donald Trump is set to enhance the United States’ Strategic Cryptocurrency Reserve by adding new digital assets beyond Bitcoin and Ethereum. The move follows the approval of spot ETFs for both leading cryptocurrencies, signaling growing institutional acceptance. Speculation centers on altcoins like Solana, XRP, and Cardano as potential additions.

Market analysts identify Litecoin, Hedera, Polkadot, Chainlink, Dogecoin, Avalanche, and Aptos as frontrunners for inclusion. Dogecoin’s $32.4 billion valuation and cultural cachet position it as a strong contender. Hedera and Chainlink, with their security-focused infrastructures, align with national strategic interests. Litecoin appears poised for ETF approval, with experts citing a 90% likelihood by year-end.

The administration’s "U.S.-controlled crypto strategy" underscores a deliberate shift toward digital asset diversification. Timing of ETF approvals remains critical, as institutional interest continues to reshape the crypto landscape.

Eco-Friendly Cloud Mining Platform VNBTC Attracts XRP Whales Seeking Sustainable Returns

VNBTC, a sustainable cloud mining platform leveraging AI technology, is witnessing increased adoption among large XRP holders. The platform's environmentally conscious approach aligns with growing demand for responsible crypto investment vehicles. Over the past fortnight, significant XRP wallet activity has flowed into VNBTC's mining contracts.

XRP's 36% weekly price surge has prompted divergent strategies among investors. While traders chase short-term gains, institutional players are allocating to infrastructure plays like VNBTC that offer consistent yield generation. The platform operates 200+ green mining facilities across 110 jurisdictions, democratizing access to Bitcoin, Litecoin, and Dogecoin mining rewards.

VNBTC's value proposition combines technical accessibility with ESG compliance - a rare combination in crypto mining. Investors can participate without specialized hardware or technical knowledge, paying for contracts in XRP. This dual focus on usability and sustainability appears particularly compelling during periods of market volatility.

SEC Delays Decision on Trump-Linked Truth Social Bitcoin ETF Until September

The U.S. Securities and Exchange Commission has extended its review period for a Bitcoin ETF proposed by Truth Social, the social media platform tied to former President Donald Trump. The agency now has until September 18 to make a determination on the application submitted by Trump Media & Technology Group.

This delay reflects a broader regulatory slowdown under new SEC Chair Paul Atkins, who has also postponed decisions on other crypto investment vehicles including the Grayscale Solana Trust and a Litecoin ETF proposal from Canary Capital. The SEC historically takes the full 270-day review period for ETF applications as it negotiates technical details with issuers.

The Truth Social Bitcoin ETF marks another attempt to bridge digital assets with mainstream finance, coming eighteen months after the SEC approved the first wave of spot Bitcoin ETFs under former Chair Gary Gensler. Those products have since attracted over $55 billion in combined assets.

Is LTC a good investment?

Based on the current technical analysis and market sentiment, LTC appears to be a promising investment. Here’s a summary of key data:

| Metric | Value |

|---|---|

| Current Price | $109.68 |

| 20-Day MA | $105.98 |

| MACD | -0.7067 |

| Bollinger Bands | Upper: $123.95, Middle: $105.98, Lower: $88.01 |

The price is above the 20-day MA, and the MACD shows signs of a potential reversal. However, investors should monitor for overbought conditions near the upper Bollinger Band.